Archive

The motivating madness of government fascism

People don’t see crises coming because they believe in the rationality of government. They don’t see the dynamic inherent in a coercive rent seeking entity that necessarily compels governments worldwide towards madness again and again and again.

WWI was madness. The Great Depression was madness. WWII was madness. Hiroshima was madness. The Cold War was madness. Chernobyl was madness. The deliberate death of the Aral Sea was madness. The destruction of arable land worldwide to convert this precious fertile land into low-density residential development is complete madness. Deliberate and govt-supported over-fishing worldwide is unsustainable madness. The GFC was predictable madness. The continued presence of the West in Afghanistan is madness.

Why do governments the world over act with such apparent suicidal, manic-depressive blind stupidity, such venal short-termism, such environmental destruction, such barbarity?

Because very simple incentive structures built up over time around the coercive activities of government compel it towards destructive barbaric madness. Simple.

Those contractors supplying government make money out of what government does. Government (originally) was developed to provide a limited range of essential services – law and order and defence. Suppliers to government have a natural incentive to try to convince government to spend more, to make government bigger. It’s an easy gig because governments can print to finance their own spending habits (unlike the private sector).

Governments then get bigger doing things they shouldn’t do. And because there is no appeal process beyond government (all you can do is appeal to another agent of government), government has a natural tendency to get bigger because nothing can stop it short of complete anarchy. So it keeps growing until chaos really does ensue.

This happens again and again throughout history and every time people are “shocked” by the chaos, by the suddenness of the social breakdown. The Soviet Union, Iran, the US in the ’60s, Cambodia, the former Yugoslavia, Europe after WWI… all these regions experienced government-induced chaos, government supported madness.

The US will experience exactly the same social breakdown, the same insane bankruptcy, the same comic-tragic stupidity. Why? Because the dynamics of government compel the country towards this inevitable denouement.

Let me explain by providing a quote from Bill Bonner of Daily Reckoning:

Bethesda is one of America’s wealthiest suburbs. Money from all over the nation rolls this way. The playing field is tilted in Bethesda’s direction.

“I was sitting in the Starbucks, having a cup of coffee,” Elizabeth reported. “One man next to me was on the phone. He was talking about some deal he had done with the US Army in Afghanistan. It sounded as though he was very happy with it. The man next to me on the other side was on the phone too. He was a jollier fellow, talking loudly about how much money he had made. I thought he was a stockbroker or something like that. Then, I realized he was talking about a contract with the government.”

While the rest of the nation has suffered a setback over the last ten years…the Washington metropolitan area has boomed more than ever. Real estate prices are down…but less than other areas.

And when we looked for a house to rent, we expected to be able to name our price. We thought it would be a buyer’s market. Not so. Nice houses in Bethesda are still being sought after. How so?

Wars…bailouts…boondoggles – this area loves them. Federal employees’ earnings keep going up…and a higher portion of the US national income goes to Washington.

People make money out of the government’s fascist madness. So the fascist madness increases.

Simple.

What’s hard to understand about rent-seeking?

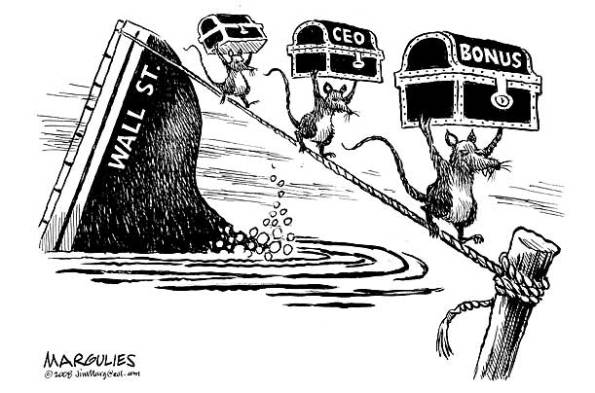

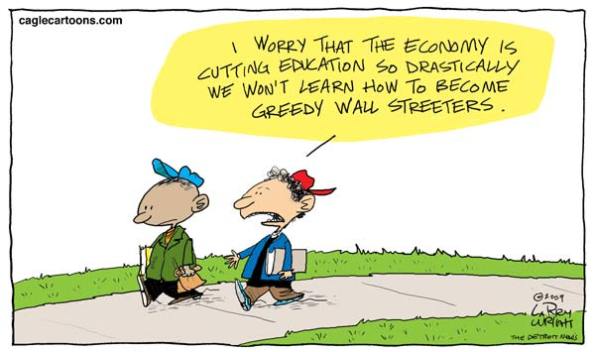

Times top editorial cartoon of 2009

Jim Willie (a.k.a. The Golden Jackass) nails it

Fantastic blockbuster post, predicting multiple, cascading sovereign debt defaults, a run on US debt and a final run to gold and silver.

I agree with all of this analysis, as can be seen in previous posts on gold, silver, fiscal Armageddon and other entries.

This is the best current synopsis on what’s coming that I’ve seen to date. The question is timing. I cannot say this will happen in 2010. But it will happen.

The only question is when.

Banks looking to lend to any mid-east sucker with a pulse after Dubai bail-out

I like my headline compared to Ft.com’s: “Risk appetite surges on Dubai bail-out.”

Who wouldn’t want to lend to Dubai now that Abu Dhabi has confirmed it will play market sucker? This isn’t moral hazard – this is a licence to print money out of the oil wells of the Middle East.

The solution? For Abu Dhabi to reign in Dubai’s excesses and slow down the debt-deals that are clearly killing the region. Circuses have got to stop – sustainable farming has got to replace the mad casinos.

Low IQ borrowers meet sharp London bankers. The mix is never good.

All fall down…

Ponzi-bankers “made off” with the gold

It appears the rats left the sinking ship a little earlier than previously thought.

You’ve got to be quick to catch fleeing rats. The vaults have already been emptied, and they appear to have stolen US bonds, art, jewellery, gold and luxury houses.

The prime choices for all the world’s embezzlers.

Bankers told to do their jobs in Dubai

Good Grief! It appears that bankers will not be saved in Dubai!

That means they’ll actually have to do their jobs – assess risk, take losses where they’ve lent too much and negotiate with debtors when they default.

It’s been so long since they’ve actually had to do their jobs, rather than being bailed out 100 cents in the dollar by corrupt sycophantic governments, do they even remember how to talk to a debtor?

How… inconvenient.

Brilliance and courage from a government leader

Let it never be said I am irrationally negative about politicians and government employees.

Here is a courageous, correct and fundamentally sound statement from the Swedish Prime Minister, Fredrik Reinfeldt, as reported in today’s Daily Telegraph:

We have been very clear that we do not put taxpayer money intended for healthcare or education into owning car companies or covering losses in car companies. You cannot save jobs just by pushing in taxpayers’ money if you don’t have the competitiveness to survive in a tough industry with overcapacity.

Wow.

I am in awe.

He is resisting pleas from the unions and pressure from GM to pour public money into Saab to save it. He is right.

What the Australian govt did in comparison was shameful.

I note that St Vincent’s Hospital may have to reduce purchases of new equipment because of $24 million in investment losses, I note that millions of dollars have been wasted on shoddy insulation due to the govt meddling in the private market for insulation in Australia, I note that hospitals are (according to the Tele) at overcapacity dealing with the spike in new births taking place, I note that billions and billions have gone to save the local car industry and the banks. From themselves.

I’m off work because of illness right now. Losing money. It wasn’t my fault.

Where’s my handout?

Once it starts, where does it stop?

The answer is it doesn’t. Until the whole system collapses and anarchy reigns.

The future will be increased volatility

With a possible default looming for Dubai, we have, with surprising rapidity, come to the next stop on our journey to Monetary Hell: Sovereign Debt Default.

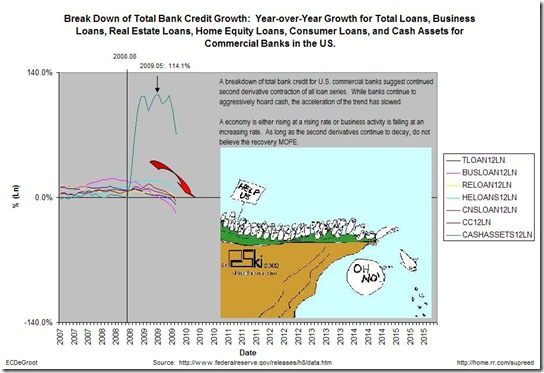

The story so far has been: (1) private consumption collapses under the weight of unsustainable accumulation of debt, as banks systematically tried to indebt every sentient being, only to find everyone went belly up at the same time (2) banks run to govt for bailouts (3) TBTF banks get bailouts, but indebt govts (4) govt budgets deficit soar due to (a) bank bailouts (b) collapsing revenues (c) increased spending on social welfare due to the spike in unemployment.

Next stop: (5) a massive spike in interest rates FOR SOME MARGINAL PLAYERS due to the flood of govt bonds onto the market, causing bond prices to collapse and yields to soar. Let’s call this “Who will be the next Iceland?”

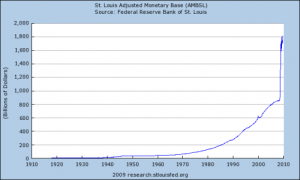

Step (5) has been delayed by govts printing up $s and buying their own bonds (particularly in the US). See this graph:

The US can do this for longer than anyone else, because they borrow in their own currency. The marginal players don’t and so they will be the next shoe to drop.

From the heart of the British Establishment publication, the Financial Times:

Markets will not soon return to the panic of September 2008: the financial sector now has state backstops. But, because of these guarantees, fearful investors have started to worry about how safe sovereign debt is. Investors are growing nervous about Greece and Ireland, in particular.

Precisely. Sovereign debt default is the next logical step in this spiral down to gold.

Picture a beggar on a busy street shamelessly going from stranger to stranger begging for a dollar. Once one person has been rejected, without a second thought, the shameless beggar goes in for another attack on another mark.

Banks – ironically – are very similar. They are shameless. They obsess about money and finding the next $, no matter where it comes from. They are desperate.

So banks have gone from prime, to sub-prime, to each other, and finally (and most shamelessly of all) to government.

What happens when government fails them?

The high-class “beggars” will go to gold.

Yes, I am aware of the recent negative correlation between crises and the gold price (gold went down on the Dubai news for example). But the US Mint has suspended sales of some coins and gold and silver are in physical short supply. You can paint a picture in the paper markets, but real physical demand is telling us something different.

At some point gold will simply be unavailable at any price. Its price will be “precisely” (ha ha ha!) infinity.

Lloyds shareholders mugged

Actually this story is incorrect.

What’s been mugged is our future.

Like all sociopathic embezzlers, bankers cannot see past today and their next spending spree. So we have no tomorrow.

Mass cramdowns = Bad karma for banks

The U.S. Treasury is urging U.S. banks to follow through on mass cramdowns.

Once the price mechanism in housing has been so distorted via embezzling Ponzi-bwankers, there is no solution. Cramdowns won’t help.

But it’s so funny watching the banks trying to get out of the mess they’re in!

Mass cramdowns are bad karma for banks. It’s a toxic, fetid swampland you wouldn’t want your worst enemy to have to escape from.

I’m quietly praying the same thing happens in Australia. That will be sweet!

NY Fed “screwed up” AIG bailout

Bernanke vs Whitney

There is no winner. We all lose.

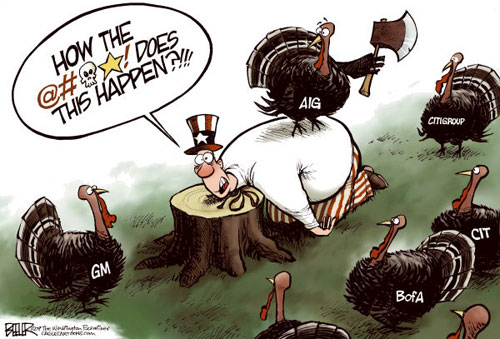

Government bailouts only make things worse

because they keep companies alive that shouldn’t exist. The longer the support, the bigger the zombie.

Inflation, then deflation…

Possibly as early as 2010!

Halloween came late this year

I missed this one… (I’ll save it for next year – it will still be relevant in 12 months time!)

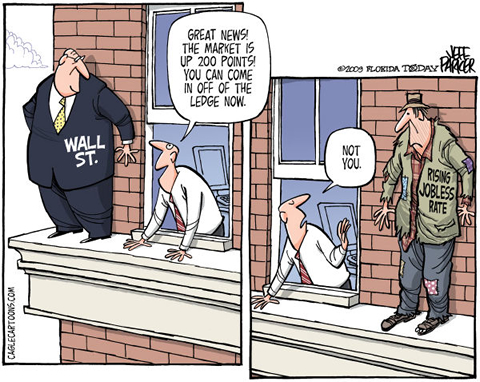

Two funny cartoons in one day!

Don’t ever say I’m not generous. Well, it is a Friday…

Come off the ledge

It’s too late, baby…

Yes, this is the only way to appropriately reduce risk.

But sometimes coming to the right policy can take so long, and the policy makers can be so slow and so stupid, the patient is already terminal and the cancer has reached advanced stages. Applying remedies that would have worked 10 years ago cannot work today. This is one of those occasions for both the US and the UK. And, perhaps, Australia.

“It’s too late baby, yeah it’s too late, though we really did try to make it. Something has died inside and I just can’t hide and I just can’t fake it…”